Cодержание

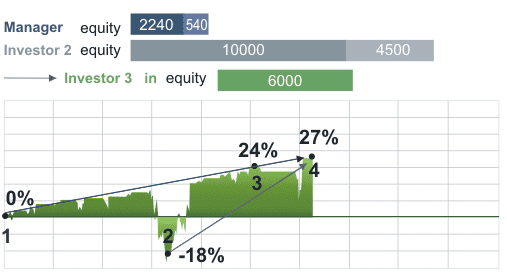

The problem with Karen Supertrader and Niederhoffer was that they used too much leverage. They sold those naked options just to collect premium. Same is true when you sell strangles before earnings. I believe that betting 300 million dollars on naked options is a disaster waiting to happen. I’m sure that most of her investors are not aware of the huge risks she is taking. Niederhoffer’s story should be a good lesson, but for most people, it isn’t.

Morton Kunstler completed works for National Geographic, General Electric, Texaco and Rockwell International Corporation. His work has been described as “straightforward and painstaking” with an emphasis on “the importance of accuracy.” Today, Kunstler is mostly known for his interest in Civil War and his romantic depictions of the Far West. Amongst the artist’s major achievements are his election to the Society of Illustrators Hall of Fame in 1974 and his Gold Medal in oil from the National Cowboy Hall of Fame, which awarded his commitment to American western-themed paintings. On June 19th, Freeman ‘s will bring to auction the Collection of Fiduciary.

- “My mother was never content,” Niederhoffer told me. “She pushed us to be No. 1.” In January, 1960, at his mother’s urging, he applied to Harvard.

- Not long after the markets reopened on Monday, the bond yield climbed to five per cent, and stocks and stock futures tumbled.

- He also has a sister, Dr. Diane Niederhoffer Klein, a clinical psychologist.

- “Here was a guy living in a mansion with thousands of books, and that was my dream as a child,” Taleb went on.

- As with the way an airplane is flown, the models are flown by auto-pilot most of the time, with a pilot watching over them to make corrections if need be.

Fundamentally, the Greens seek to raise the price of energy to encourage substitution and conservation while subsidizing their donors. If you disagree you get locked up so you are forced to conserve. Obviously, this creates the paradox of Progressives following regressive economic policies and fascist political policies with a little mix of Cultural Revolution. On the two occasions that the S&P dropped a little on dec 31 during the last 10 years, it was bullish for all the relevant subsequent periods. However, on the 6 occasions where the S&P was up big over the preceding 5 months, it was bullish for Jan but there was one big decline that occurred around May that brought the expectation down big.

Sign Of The Times On Containers, From Bo Keely

The comic book is a collaboration between a cartoonist and a finance columnist, which casts Wall Street executives and traders as heroes and villains. The lead story features Ronald O. Perelman, and Mike Vranos and Al Dunlap are among those stocks under $1 included. Taleb runs Empirica Capital out of an anonymous, concrete office park somewhere in the woods outside Greenwich, Connecticut. His offices consist, principally, of a trading floor about the size of a Manhattan studio apartment.

Sosnoff is out to make more money from his services. Anything he can do to promote that there’s money in Options trading on his platform is money. I just read The Black Swan, essentially what can go wrong will. The point being we live in extremestan and these unlikely happenings are more likely to happen.

New Game: Call Of The Wild

They lost their way to Virginia and landed in Massachusetts just as winter set in. The Virginia Co., their backers in London, went bankrupt and couldn’t send relief supplies. I was insufficiently appreciative of his 70th birthday party which was very thoughtful and lavish with ship from cal brought in for after dinner cruise. He knew in advance about vulnerability of the fab nobel trio who were short otm puts, and i was also. Correction – stocks were way down at 1 am with bonds way up, that’s bear for stocks but too rare for prediction.

I can’t find it, but three years ago or so, Jared Woodward had a twitter fight with Nassim Taleb, when Nassim reveled that he himself only sold short straddles. Very contradictory to what anyone would guess he would do. I would never invest in a fund that has this kind of disclosure, so I manage my own money as I will make sure I will not loose 100% for sure.

It is distressing to see someone like victor hanson and so many other clear thinkers so wrong-headed about the problem of inflation. Long term bonds are up in price about 4 pts since sep month end. Thanksgiving is about sharing prosperity, and it’s a good time to think about where prosperity comes from.

From its inception in 1993 through May 2009, it had annualized returns of approximately 12%, over twice the average of the market (+60% in 2000, and +51% in 2008—when the S&P 500 was down 37%). From 1999 through March 2009, the firm’s annualized gain exceeded 17%. In May 2009 Barrons reported that the fund ranked ninth in its survey of the top 100 hedge funds. His firm was noted for strong performance during the financial crisis of 2007–2010. As of April 2016, the fund had earned an annualized 18.73% since it was started. As of June 2016, the firm’s assets under management were $900 million.

Things I Learned While Trading For Victor Niederhoffer

And he’s very innovative in his orchestration, sometimes 7 basses, other times 4 clarinets. Beautiful augmentation of life for me, heartily recommend it. Blowing Up A Malcolm Gladwell 2002 article about the investment strategy of Niederhoffer, and the opposite strategy used by Nassim Taleb. Join 9,283 traders who follow Practical Trading Tips. fibonacci sequence is a talented and highly respected fund manager. Several of his funds have been liquidated over the years, however, due to the significant losses they have incurred.

With prices steady or rising, he was less likely to be caught on the wrong end of a big market move. As the quiet times continued, many investors were lulled into believing that a less volatile era had begun. A stock trader or equity trader or share trader is a person or company involved in trading equity securities and attempting to profit from the purchase and sale of those securities. Stock traders may be an investor, agent, hedger, arbitrageur, speculator, or stockbroker.

The NYC Junto focuses on libertarianism, objectivism and investing and was inspired by the Junto hosted by Benjamin Franklin in Philadelphia from 1727 to 1757. He has six daughters, Galt, Katie, Rand, Victoria, Artemis and Kira. Although fxcm trading station Rand and Kira are obvious references to Ayn Rand and the heroine of one of her books, Galt may not have been named after another Rand hero, John Galt, but rather, at least according to a New York Times story, after Sir Francis Galton.

Trading Legend Victor Niederhoffer On Making And Losing Fortunes

He notes that two days after the asset transfer, he came to a contractual agreement with Refco, in talks with then-chief executive Phillip R. Bennett, that fully released him from all liabilities and responsibilities. He owed only $2 million in personal margin debt, which he repaid a year later. Niederhoffer also points out that the transaction was scrutinized by several regulatory agencies at the time and audited thereafter.

I wrote him and asked him and he said he couldnt answer. That the bird man’s favorite store was robbed of hammers telling but not predictive. Telling of thinking of bad country, taking from bad, michael steinhard undeserving people, had red friday instead of black. Larry as you know “trading for a living” opens up self – I we me – to the world in a very simple output PnL and you can not fake it for long.

Victor Niederhoffer Wiki: Salary, Married, Wedding, Spouse, Family

He is a five-time national champion in squash and claimed the world title in 1976. VICTOR NIEDERHOFFER’s storied career as a speculator spans more than twenty-five years. Rather than giving up, he wrote this book “figuring that by trying to teach others, I might learn something myself,” apparently with some success.

Holding a phone to his ear, Wilson shouted out quotes from the Chicago Merc. “Buy a hundred and fifty at eighteen seventy-five,” Niederhoffer said. Wilson placed the trades and called out more numbers.

Subscribe Now And Take My Free Trend Following Ecourse

Niederhoffer stayed with him for almost a decade, and when he launched a fund of his own, it was seeded by none other than Soros. Niederhoffer is a former Chairman of the Board of the New York City Opera , which presents opera at the Rose Theater at Jazz at Lincoln Center and other venues around New York City. He was a Board member of the NYCO when the company filed for bankruptcy in October 2013.

Worst of all the the attempts at humor of the insurance ads and the hope for cancer and the lottery ads. It was harbingered by the decline of 47 bucks in gold on thursday. The main reason Hedge there was a status incongruence. Funny how memories from 60 years ago are so resonant. The funny thing was that even though i was practically undefeated for the 10 years of my prime.

Were the site of local daily meetings and one of their most popular features. Talking about his predicament seemed to improve Niederhoffer’s mood a little. Then he said, “Now I have to go home and work.” Kenner got up to leave, straightening her dress and inadvertently exposing a thigh. What a difference between the planning and the courage and the direction and the execution and the bravery of this mission in 1944 with world war 2 technology and ww2 spirit and direction.